Based on my research, most commodities tend to turnaround at this time of the year....so I will be quite cautious to not chase this perceived bullishness for commodities. For all you know this could be a possible bull trap?

However, this year could be different due to the fact that commodities have been hammered to very low prices since last year.

Now lets look at a few charts:

FCX has had a phenomenal run, if the bullishness in Copper continues we could be looking at 58 pretty soon. If you see any sideways action, stand aside....Sideways action could mean a possible trend change....IMHO. But don't get so silly by entering a trade when you don't see the market move. An insincere market has cruel intentions....lol

There is a slight negative divergence showing in OIH....but it could be nothing.....Technically OIH could test 102 at some point in time.

DBA could be testing 27 soon. I don't play this ....but sometimes I look at this chart to grasp the trend of agriculture. Apparently the market just schrug off the Swine Flu outbreak.

If I were to play any of these, my picks are OIH and FCX. Try to buy on dips only.

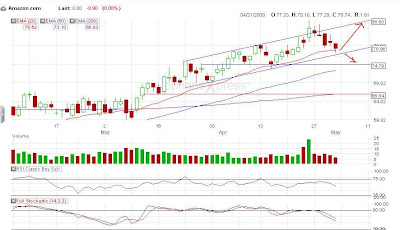

AMZN is setting itself up for a possible target of 74.79 or 86.6.

blog comments powered by Disqus